In enterprise retail, the physical store isn't just a point of sale. Locations are assets in a broader network, each acting as a node in a dynamic portfolio designed to support omnichannel commerce, fulfillment, and brand presence across entire markets. Stores are interconnected, and their performance matters in aggregate as much as individually.

For enterprise marketers and local SEO teams, this presents both a challenge and an opportunity. Measuring individual store visibility is important — but interpreting each store's performance in isolation is a mistake.

Enterprise retailers need cross-portfolio performance benchmarking: a method to understand not only how each store ranks in local search, but how the network as a whole is performing, where visibility gaps exist, and which strategies scale across regions, formats, and customer segments.

Local Falcon provides the granular visibility intelligence needed to maximize performance at the store level, but the real value comes when that data is analyzed across the whole retail portfolio.

The Store as a Portfolio Asset

Large enterprise-level retailers don't view stores as standalone locations. Instead, each store is treated as a node within a broader portfolio, interconnected with other locations, distribution channels, and fulfillment capabilities.

In this model, individual stores are dynamic assets: their size, format, or role can be adjusted based on performance, market demand, or operational priorities. Visibility and connectivity across the network are just as important as the performance of any single location.

This approach illustrates a simple principle: in enterprise retail, the network matters. Measuring performance at a single store is only the first step; the real insights come from understanding how each store contributes to the overall portfolio and identifying patterns across the network.

Why Store-Level Rankings Alone Aren't Enough

Local search rankings have traditionally been used to compare individual stores against each other and against local competitors, revealing which locations lead, which fall behind, and which may need attention. While these measurements remain important, they are not enough on their own for enterprise decision-making.

Enterprise challenges include:

- Contextual Variance Across Markets: A #3 ranking in a rural trade area does not equate to a #3 ranking in a dense urban core. Store performance must be understood relative to competitive density, market size, and local customer behavior.

- Differing Store Formats and Customer Types: Small-format urban stores, campus locations, and flagship stores all operate under different constraints and opportunities. Comparing them directly without segmentation obscures meaningful insights.

- Systemic Patterns Are Hard to Detect: Individual rankings may flag outliers, but trends across regions, formats, or store cohorts often remain invisible.

- Risk and Opportunity Are Hidden: Without cross-portfolio benchmarking, visibility gaps in strategically important markets may go unnoticed until revenue is impacted.

In short, store-level visibility measurement is essential, but enterprise-grade insights require network-level analysis.

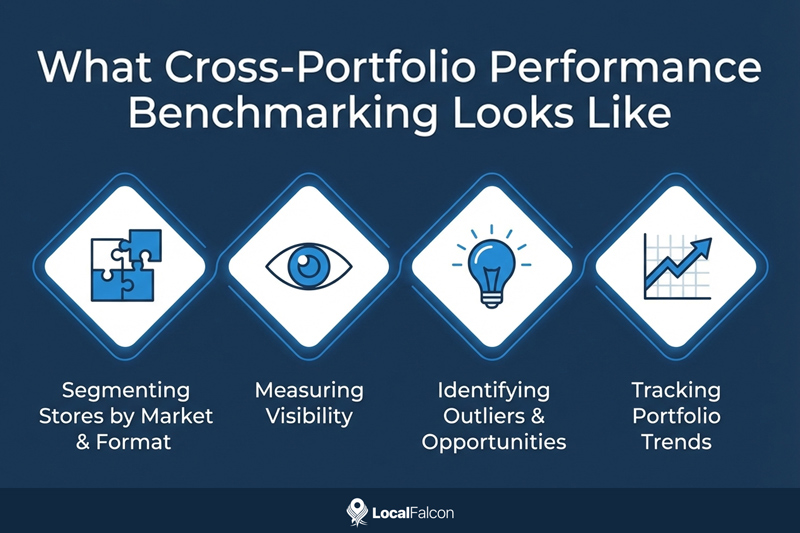

What Cross-Portfolio Performance Benchmarking Looks Like

Cross-portfolio performance benchmarking moves beyond simple rankings to analyze patterns across the network. This involves:

- Segmenting Stores by Market and Format: Benchmarking urban hubs against other urban hubs, small-format stores against similar locations, and pro-oriented stores against comparable service zones ensures fair comparisons.

- Measuring Relative Visibility: Each store's visibility is evaluated not just in isolation, but in relation to peers, competitors, and portfolio expectations.

- Identifying Outliers and Opportunities: By aggregating store-level data, teams can detect underperforming regions, top-performing examples, and areas where strategic initiatives can have the greatest ROI.

- Tracking Portfolio Trends Over Time: Benchmarking across the portfolio allows enterprises to detect seasonal shifts, changes in competitive dynamics, and the effects of operational initiatives before they impact revenue or market share.

The result is actionable, portfolio-level intelligence that empowers enterprise teams to make strategic, data-driven marketing decisions rather than reactive, anecdotal ones.

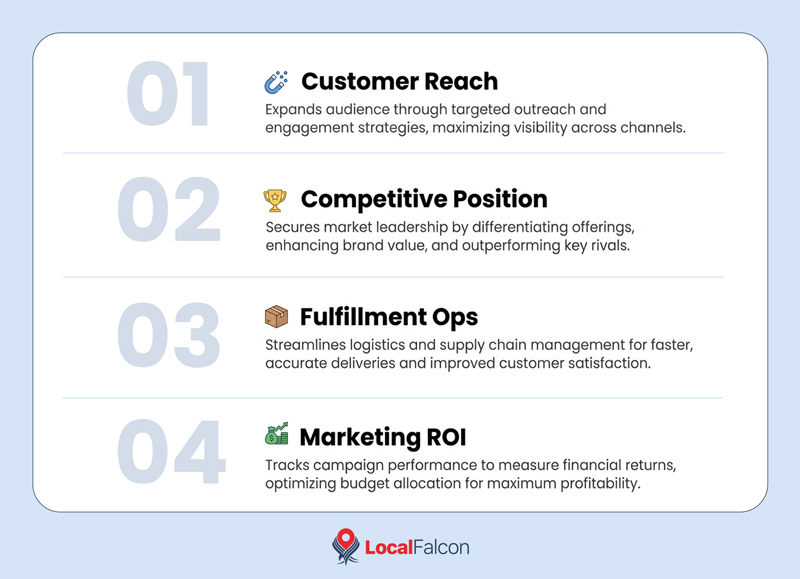

Why Visibility Intelligence Matters for Enterprise Retail

Enterprise retailers increasingly recognize that local visibility is more than just an SEO outcome — it's a leading indicator of overall portfolio health.

Visibility influences:

- Customer Reach: Are target audiences able to find the store when searching locally or through omnichannel apps? Poor visibility can lead to missed transactions, even if inventory and pricing are optimized.

- Competitive Positioning: Cross-portfolio benchmarking highlights which stores are losing visibility to competitors and why, allowing marketers to intervene before patterns become entrenched.

- Fulfillment and Operational Decisions: Visibility data informs store-level operations, from staffing to inventory allocation to local promotions. When viewed across the portfolio, it also supports decisions about store resizing, format changes, or expansion.

- Marketing Investment Optimization: Benchmarking allows teams to allocate resources where they'll have the greatest impact, whether that's enhancing digital presence for underperforming nodes or scaling strategies across top performers.

Turning Visibility Data Into Actionable Enterprise Intelligence With Local Falcon

Local Falcon measures your local rankings and visibility across AI platforms and Google Maps, providing the granular, location-specific data that enterprise retailers need to act. Its power grows exponentially when that data is analyzed across the portfolio, transforming raw metrics into strategic intelligence. Key capabilities include:

Geo-Grid Visibility Maps

Evaluate each store's visibility across hundreds of points within a trade area, capturing a complete picture of how locations appear and each trade area's visibility saturation. These geo-grids allow teams to visualize strengths, gaps, and competitive exposure in a way that simple city- or zip-code level rankings cannot.

Competitive Benchmarking

Compare store performance against local competitors to uncover risks and opportunities at the market level. By understanding how each location stacks up against the actual competition, enterprises can prioritize optimizations where they will have the most impact.

Portfolio-Level Aggregation

Roll up individual store data into a network-wide view to reveal patterns, trends, and systemic insights. Portfolio-level aggregation makes it easy to spot underperforming regions, top-performing stores to model across the portfolio, and areas where operational or marketing strategies can be scaled.

Campaigns for Segmented Portfolio Tracking

Organize stores into campaigns to track visibility consistently across similar locations or markets. Enterprises can create campaigns for rural stores, urban hubs, small-format locations vs large-format stores, etc., applying the same scan settings across all nodes in each group. This approach standardizes measurement, enables meaningful comparisons, and provides a clear view of how different segments of the portfolio are performing over time.

By combining store-level granularity, portfolio-wide analysis, and segmented campaign tracking, Local Falcon moves enterprise teams beyond reactive ranking comparisons. Visibility becomes a strategic tool, guiding operational, marketing, and growth decisions.

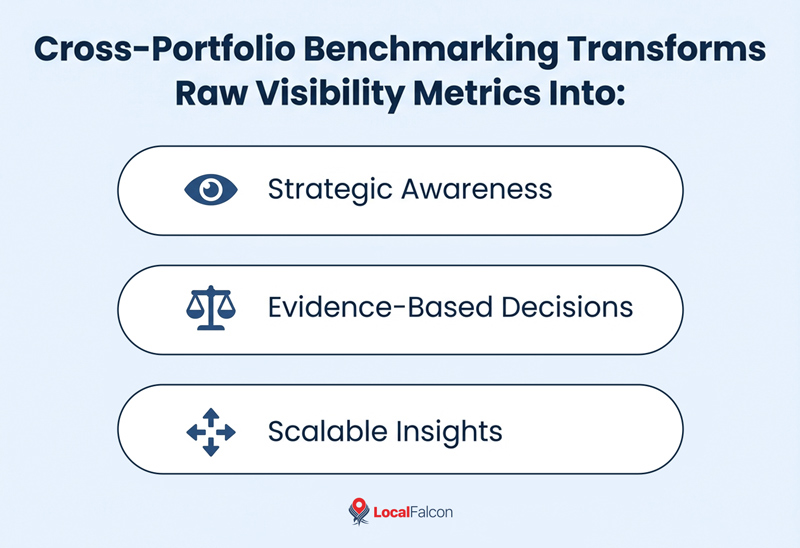

From Measurement to Strategic Insight

Measuring each store's visibility is only the starting point. The true enterprise advantage comes from interpreting that data in the context of the portfolio.

Cross-portfolio benchmarking transforms raw visibility metrics into:

- Strategic awareness of where the brand is strong and where it is vulnerable

- Evidence-based decision-making for local marketing and operational investments

- Scalable insights that can be applied across hundreds or thousands of locations without losing context

In the world of enterprise marketing — where stores are not isolated points of sale — visibility intelligence must also be network-aware. That's how enterprise retailers ensure their physical and digital assets work together, reinforce each other, and support long-term growth.

Conclusion

When it comes to enterprise retail, stores are nodes in complex networks, and visibility is a performance metric with both local and portfolio-level implications. While measuring individual store visibility is essential, it is the benchmarking across the portfolio that transforms data into enterprise intelligence.

Local Falcon empowers enterprise retailers to:

- Capture granular visibility intelligence for every store

- Compare and contextualize performance across markets and store types

- Identify risks and opportunities before they impact the business

- Align marketing, operational, and strategic initiatives with visibility-driven insights

In short, visibility measurement at the store level is just the beginning. Cross-portfolio benchmarking turns those measurements into a strategic advantage, enabling enterprise retailers to optimize performance across the network, not just at individual nodes.